Homeowners Insurance in and around Zebulon

If walls could talk, Zebulon, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

It's so good to be home, especially when your home is insured by State Farm. You never have to be concerned about the unexpected with this fantastic insurance.

If walls could talk, Zebulon, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Why Homeowners In Zebulon Choose State Farm

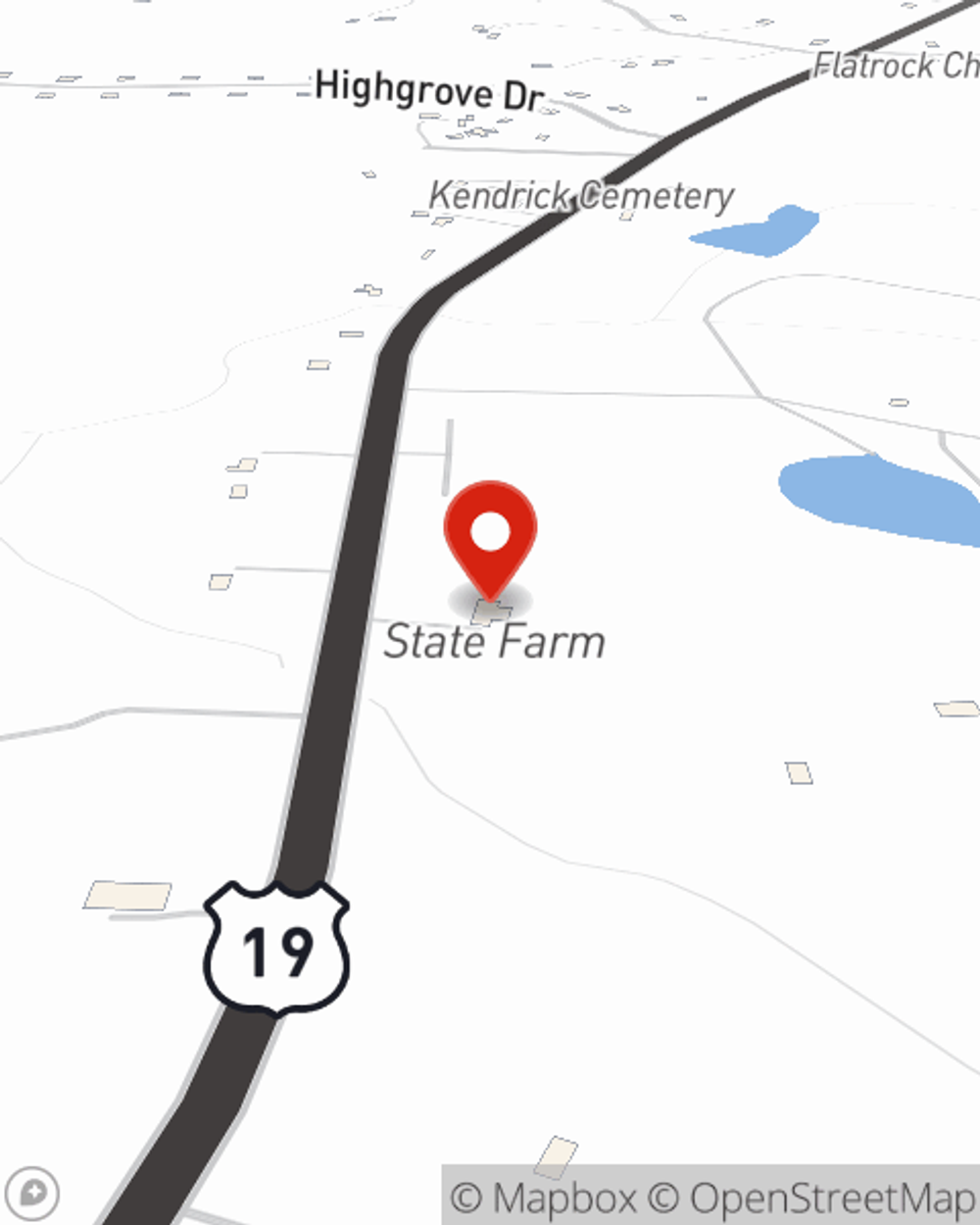

Excellent coverage like this is why Zebulon homeowners choose State Farm insurance. State Farm Agent Janice Honeycutt can offer coverage options for the level of coverage you have in mind. If troubles like service line repair, wind and hail damage or identity theft find you, Agent Janice Honeycutt can be there to help you file your claim.

Now that you're convinced that State Farm homeowners insurance should be your next move, call or email Janice Honeycutt today to find out next steps!

Have More Questions About Homeowners Insurance?

Call Janice at (678) 408-4545 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.

Janice Honeycutt

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.